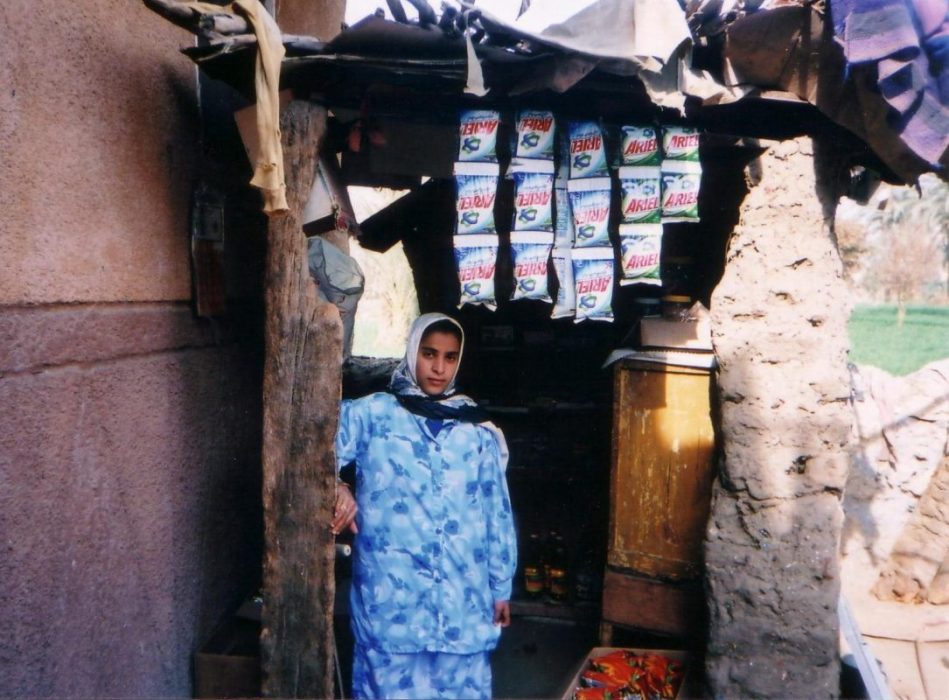

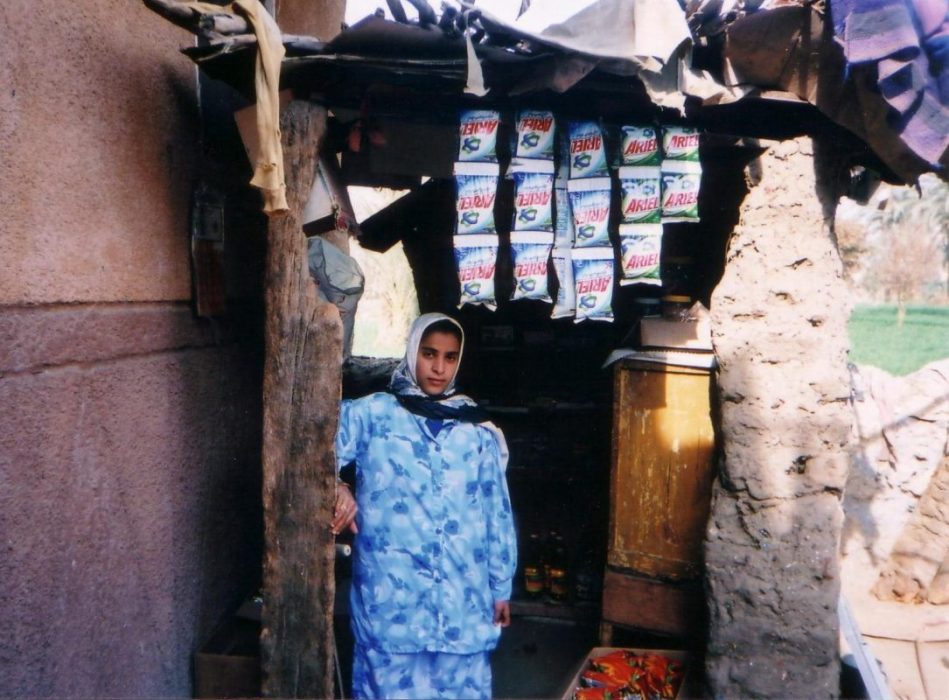

In 1994, ACDA obtained a grant from the Canadian International Development Agency as revolving loans for children with special needs and their families in order to help them with the disability-related problems. Furthermore, in 1995, it received a loan from the Social Fund for Development for the Mothers of Children in Community Schools, in order to encourage them to enroll their daughters to education.